What is Supply Chain Financing?

SCF is a way to optimize working capital and reduce supply chain risk; SCF allows businesses to increase supplier payment terms – while giving suppliers the option to get paid early.

What is Supply Chain Financing?

SCF is a way to optimize working capital and reduce supply chain risk; SCF allows businesses to increase supplier payment terms – while giving suppliers the option to get paid early.

Every Supply Chain Finance Program Consists of

Two Main Components:

Extending Buyer

Payment Terms

Providing Suppliers with

an Early Pay Option

Every Supply Chain Finance Program Consists of

Two Main Components:

Extending Buyer

Payment Terms

Providing Suppliers with

an Early Pay Option

We Support Both

Buyer-Centric and

Supplier-Centric Supply Chain Finance Models

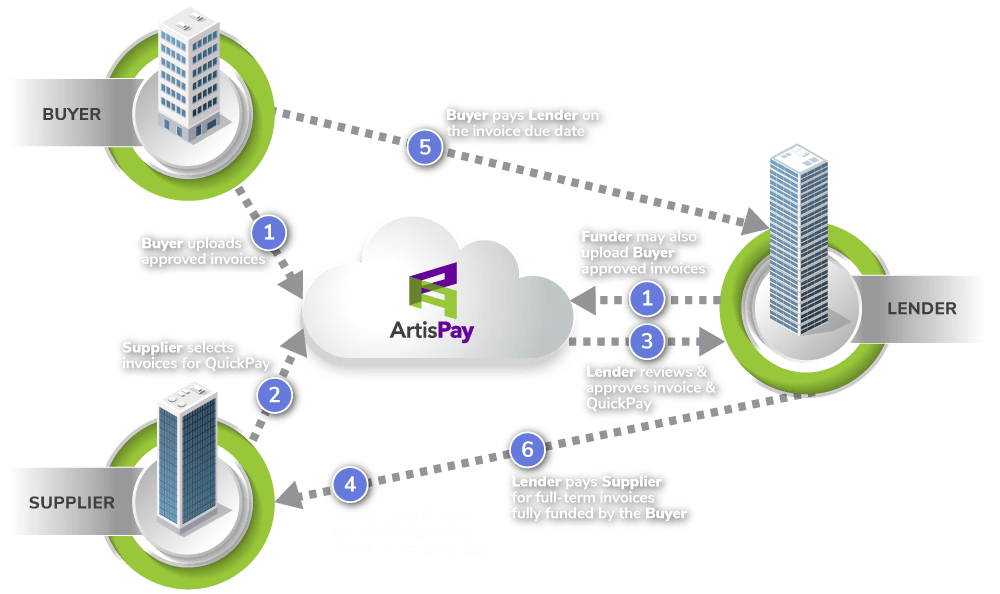

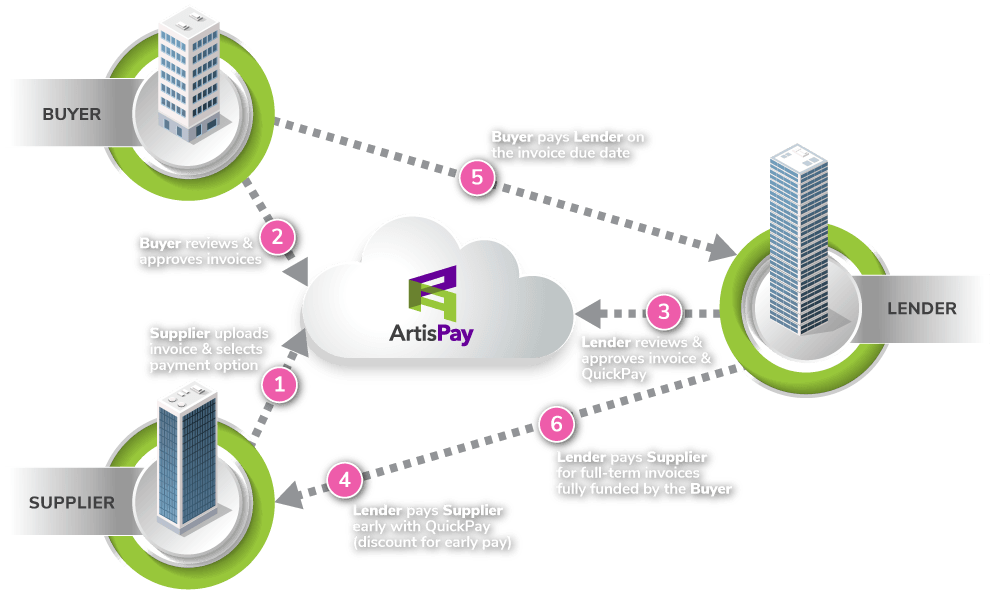

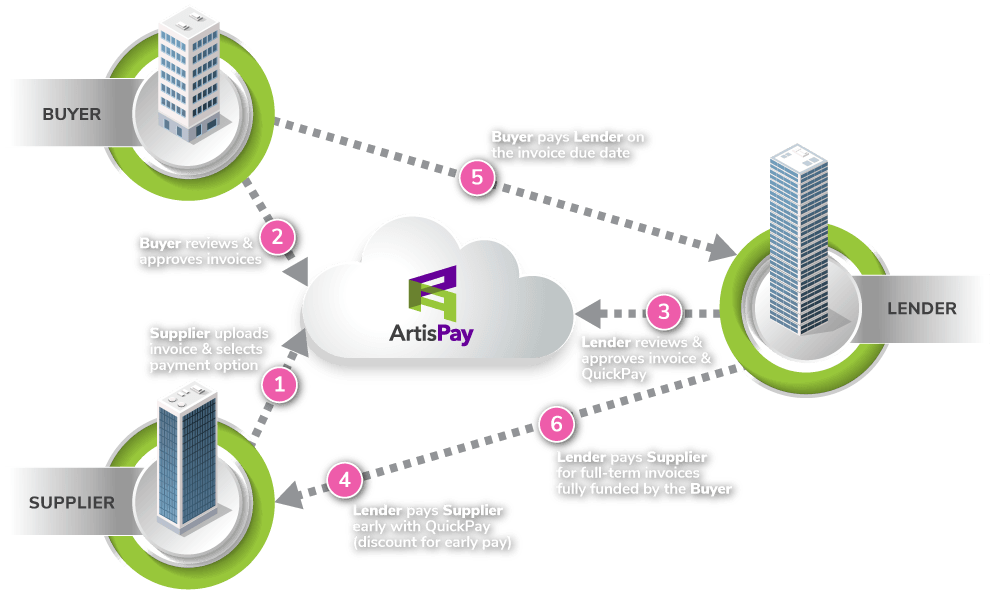

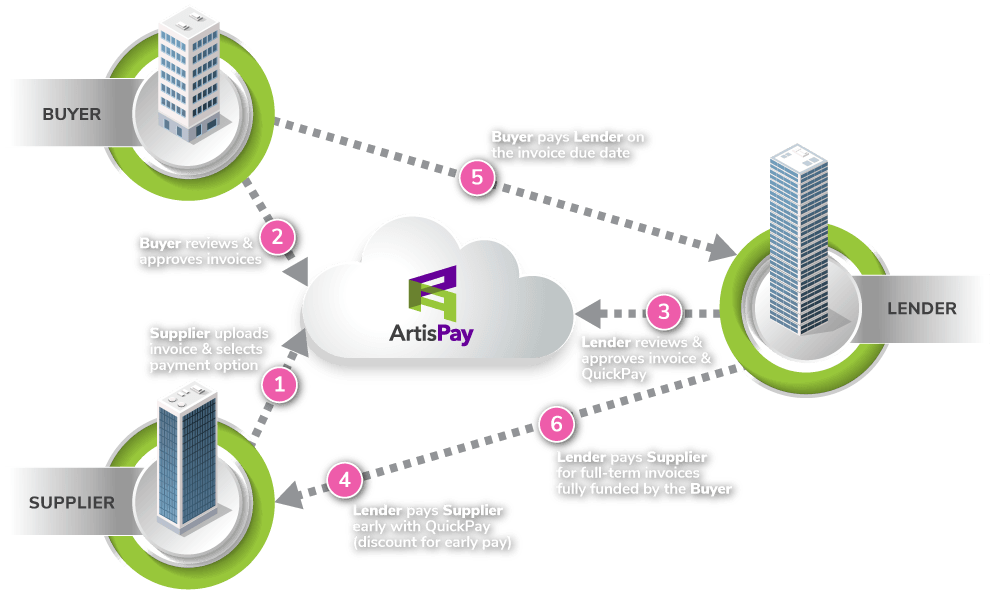

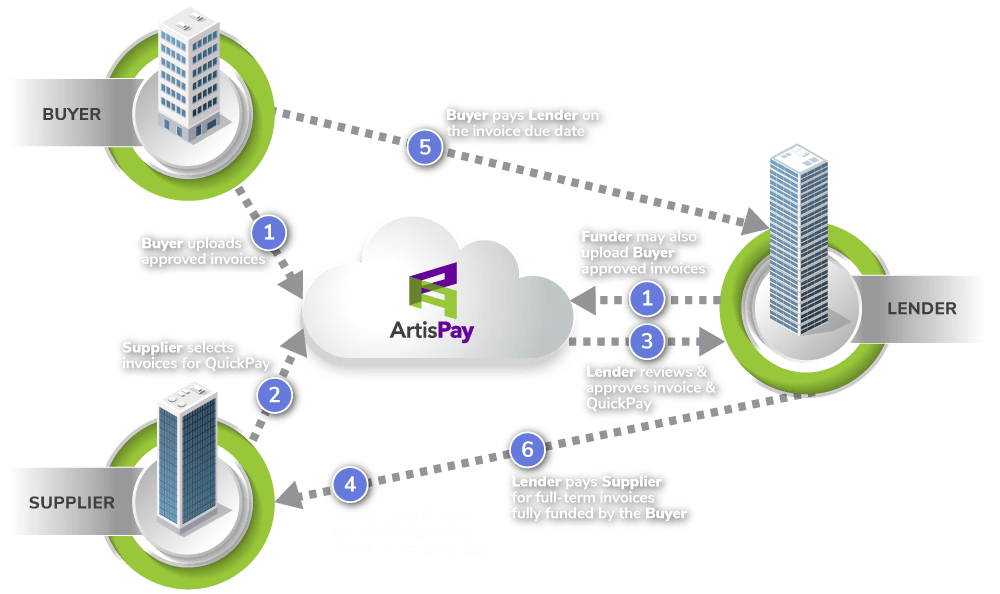

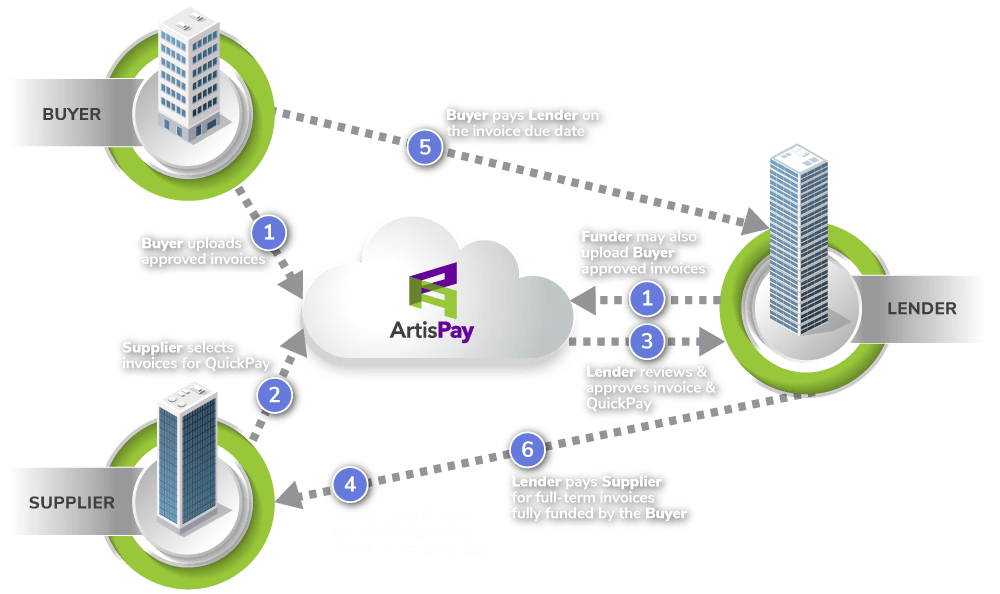

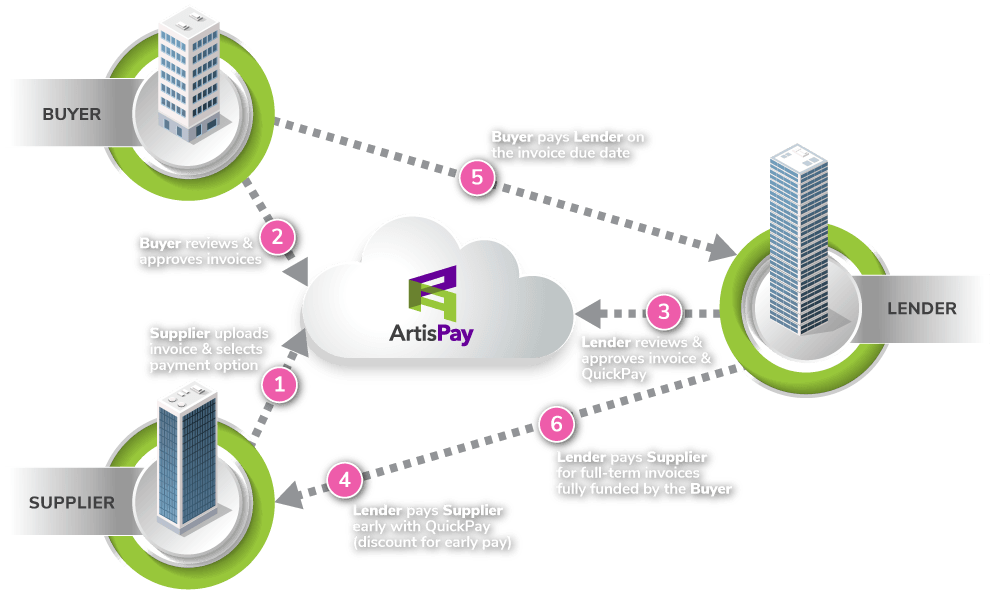

ArtisPay’s Buyer-Centric

Supply Chain Finance Model

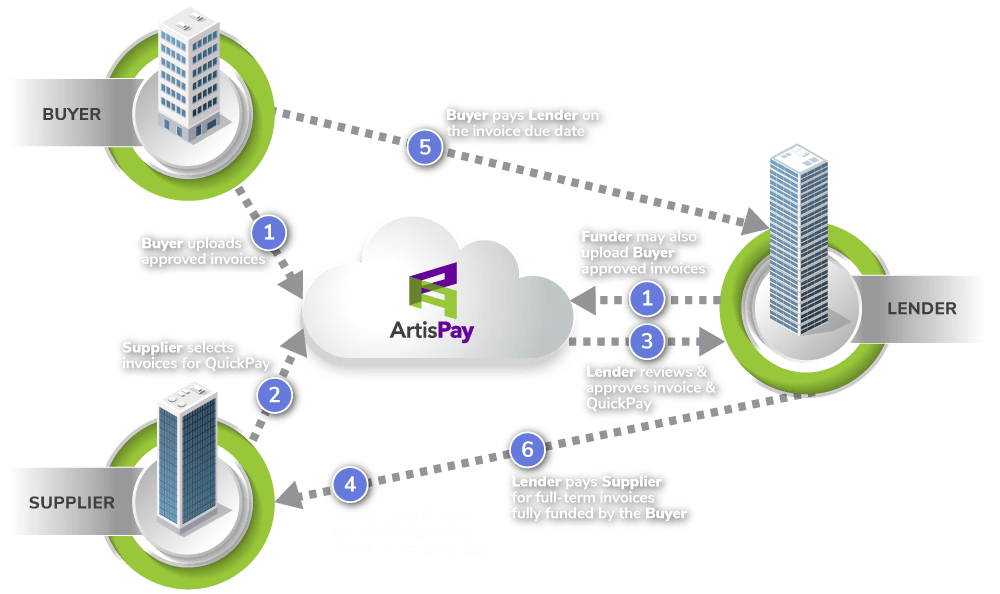

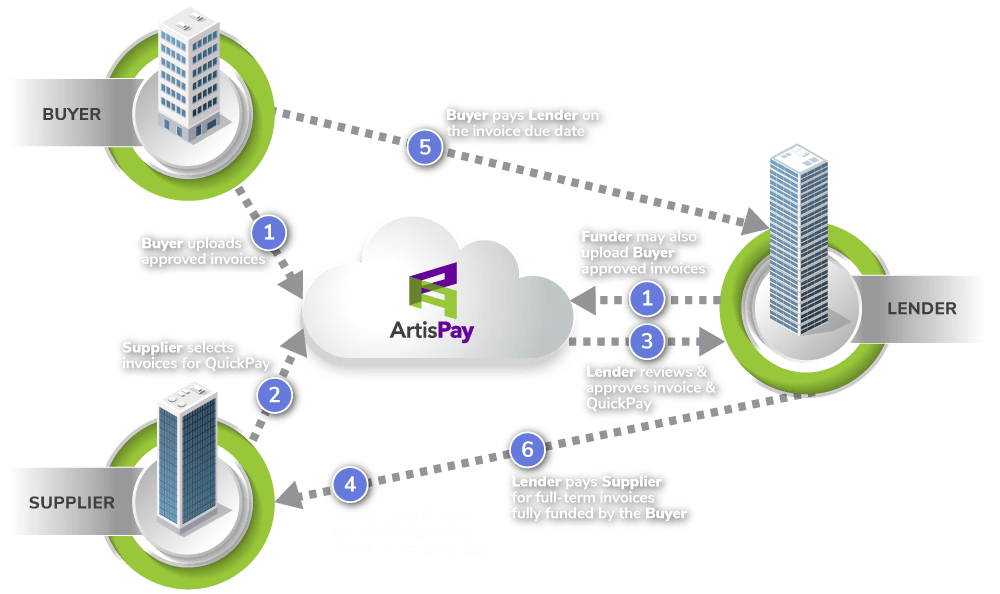

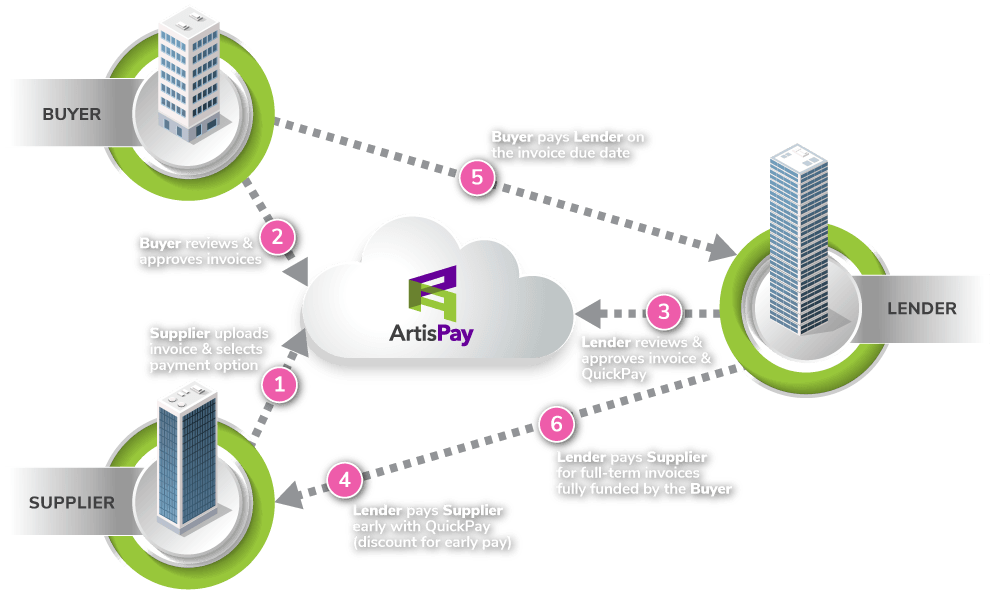

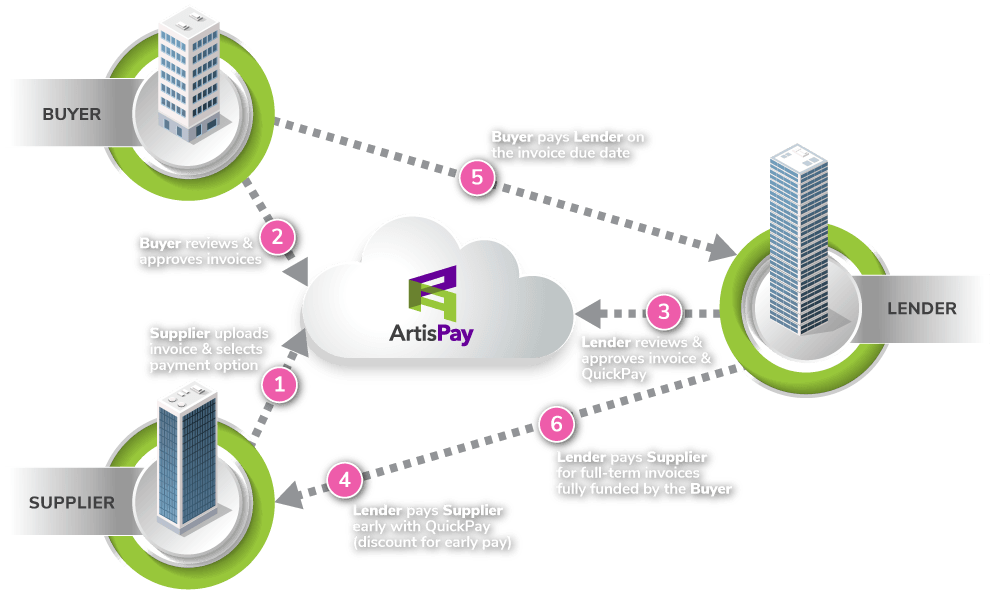

ArtisPay’s Supplier-Centric

Supply Chain Finance Model

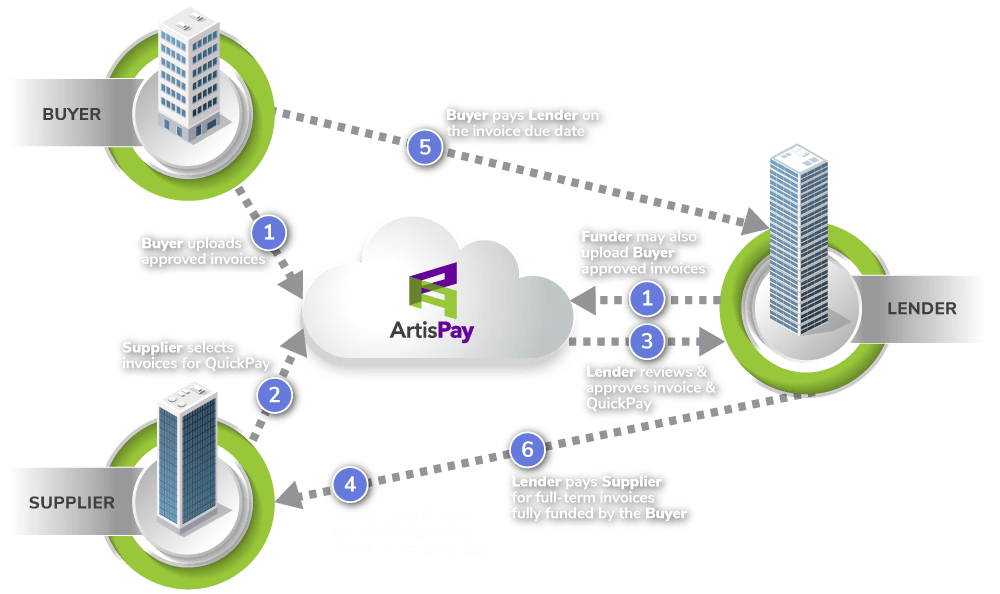

We Support Both Buyer-Centric and

Supplier-Centric Supply Chain Finance Models

ArtisPay’s Buyer-Centric Supply Chain Finance Model

(pinch image to enlarge model)

ArtisPay’s Supplier-Centric Supply Chain Finance Model

(pinch image to enlarge model)

Supply Chain Finance Unlocks the Cash that’s Hidden Inside Your Supply Chain!

Buyers

Increasing the time it takes to pay a supplier improves several financial metrics and most importantly, frees up cash that would otherwise be trapped inside the supply chain.

Suppliers

Supply chain finance offers suppliers a way to mitigate the effects of payment term extensions and to accelerate their own cash flow.

Schedule a Demo

Don’t just take our word for it, let us show you!